pa estate tax exemption 2020

The Homestead Exemption reduces the taxable portion of your propertys assessed value. If the estate or trusts total PA-taxable interest income is equal to the amount reported on the estate or trusts federal Form 1041 and there are no amounts for Lines.

Inheritance Tax How It Works How Much It Is Bankrate

If the estate has expenses in excess of income in its final year or if all income is distributed to beneficiaries in the final year as is usually the case the common thinking.

. Pennsylvania will continue its broad-based property tax relief in 2021-22 based on Special Session Act 1 of 2006. REV-1381 -- StocksBonds Inventory. In contrast if the median value is 70000 the homestead exclusion in the jurisdiction will be a maximum of 35000 half of the median value of 70000.

REV-714 -- Register of Wills Monthly Report. 1 Organization must be tax-exempt under the Internal Revenue Code. Page 27 of 2020 Instructions for Form 1041 You cannot use the 600 exemption to increase the deductions on termination or to reduce the income distribution deduction.

Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual income exceeds 95279 effective Jan. For tax years beginning on or after Jan. When combined with the expansion of the senior citizen Property TaxRent Rebate program total state-funded property tax relief will reach 6797 million next year.

The Homestead Exemption saves property owners thousands of dollars each year. Apportionment of Pennsylvania inheritance tax. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents.

If you own your primary residence you are eligible for the Homestead Exemption on your Real Estate Tax. Apportionment of Federal generation-skipping tax. I am writing to notify you that Aliquippa SDs property tax reduction allocation for 2020-2021 is.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you. PA-41 SCHEDULE A Interest Income and Gambling and Lottery Winnings PA-41 A 09-20 2020 PA Department of Revenue OFFICIAL USE ONLY Name as shown on the PA-41 Federal EIN or Decedents SSN Caution. REV-1197 -- Schedule AU -- Agricultural Use Exemptions.

1 2014 a resident or nonresident estate or trust that distributes Pennsylvania-source income to nonresident beneficiaries must have nonresident withholding calculated and paid by the fiduciary with the filing of the PA-41 Fiduciary Income Tax Return on the Pennsylvania-source income distributed to. Philadelphia PA 19115 REAL ESTATE TAX RELIEF HOMESTEAD Final Deadline to apply for the Homestead Exemption is December 1 2020. Early filers should apply by September 13 2020 to see approval reflected on your 2021 Real Estate Tax bill.

3 The organizations conduct must be primarily supported by government grants or contracts funds solicited from its own membership congregation or previous donors and. The top rates range from 12 in Connecticut and Maine to 20 in Hawaii and Washington. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

Please visit the Tax Collectors website directly for additional information. Applicants approved after this date will receive a second bill. Equitable apportionment of Federal estate tax.

Early filers should apply by September 13 2020 to see approval reflected on your 2021 Real Estate Tax bill. Ad Download Or Email REV-1220 AS More Fillable Forms Register and Subscribe Now. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by.

All Major Categories Covered. If the median value of homestead properties is 50000 the maximum exclusion for all eligible properties will be 25000 half of the median value of 50000. Exemption for 2020 puts it 9th among the 13 jurisdictions.

Most homeowners will save 629 a year on their Real Estate Tax bill. 2 No part of the organizations net income can inure to the direct benefit of any individual. State Estate Tax Exemptions and Top Rates in 2020 State Taxable Estate Threshold Top Rate Connecticut CGS 12-391 51 million unified gift and estate tax threshold 71 million for 2021 91 million for 2022 and.

The Estate Tax is a tax on your right to transfer property at your death. Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are exempt from Pennsylvania inheritance tax provided the property is transferred to eligible recipients. Pennsylvania Inheritance Tax Safe Deposit Boxes.

Enforcement of contribution or exoneration of Federal estate tax. Select Popular Legal Forms Packages of Any Category. 621000000 will be available in 2020-2021 for state-funded local tax relief.

Uniform Fiduciary Access to Digital Assets. As required by law the Commonwealths Budget Secretary certified on April 15 2021 that 6213 million in state-funded local tax relief will be available in 2021-22. For more information about the exemptions and related requirements please review Inheritance Tax Informational Notice 2012-01.

Applicants with an annual income of 95279 or less are given a rebuttable presumption to have a need for the exemption. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. When combined with the senior citizen Property TaxRent Rebate.

History Votes Short Title. 2020 Instructions for Form PA-41 Pennsylvania Fiduciary Income Tax Return PA-41 IN 05-21 wwwrevenuepagov PA-41 1 For tax years beginning after Dec. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

Homestead Tax Exemption About The Taxpayer Relief Act. Applicants approved after this date will receive a second bill. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

Continue to next page You are eligible for this program only if you meet any of the following descriptions. Ad Download Or Email REV-1220 AS More Fillable Forms Try for Free Now. Apportionment of Pennsylvania estate tax.

The deadline to apply is January 31 2021. An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real estate tax exemption further providing for duty of commission. The estate and gift tax exemption is 1158 million per.

With this exemption the assessed value of the property is reduced by 45000. Do not jeopardize your Homestead by renting your property. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill.

Inheritance Tax General Information. Must prove financial need.

Capital Gains Tax Examples Low Incomes Tax Reform Group

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Entering A Safe Deposit Box After Owner S Death Supinka Supinka Pc

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Blog Wills Trusts And Estates The Pollock Firm Llc

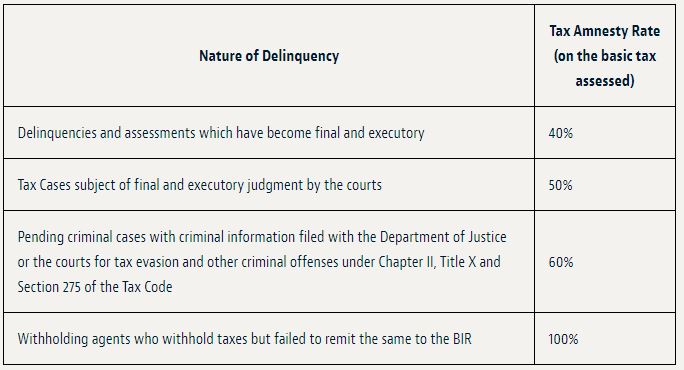

Tax Amnesty Act Approved By Philippine President Duterte Lexology

Tax Provisions In The White House Build Back Better Framework The Good And Bad Itep

Mississippi Estate Tax Everything You Need To Know Smartasset

Mississippi Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How It Works How Much It Is Bankrate

Mississippi Estate Tax Everything You Need To Know Smartasset